Faq

Most Popular Questions

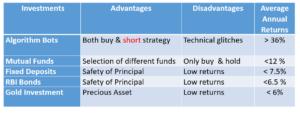

Our intention/purpose/core objective is to read market patterns through advanced algorithms which can identify opportunities in financial markets to generate “buy & sell” signals consistently without resorting any human interventions and trade without fear & greed.

- Historically back tested strategies give you the ability to know the risk involved before deploying the strategy.

- Last 5 years of Back testing can show you simulated results of how particular asset class has performed in the stress areas like “ demonetization & GST changeover disruptions, surgical strike, News days like Budgets, Corporate Financial results ,Natural disasters, Border intrusions, Covid pandemics etc.

- We have the Core Strategies developed and ready for deployment.

Market Nature is Trending, volatile & sideways. A Good strategy adapts to all market condition and generate Consistent ROI. Ideal holding period would be 1 year to fetch a 36 % returns annually. Our strategy had performed exceptionally well under stress areas like covid, demonetisation & political changes, economic policies from RBI, union budgets etc. you can download the excel sheet of simulated trades under download section.

Our backtested strategies have drawdown less than 20 % for the last 5 years, excluding commissions and other charges, We don’t guarantee for any losses, though we can mitigate risk upto 20 % of the intital equity, as Drawdown is an integral part of trading. we would intimate the client if the drawdown exceeds 20 % of the Intitial equity.

For complex strategies like option writing we use python, for a traditional indicator based strategies we use Amibroker latest version.

You need to share 30% of the Profit made only if Profit exceeds the initial equity , Our charges are invoiced only at the end of the year once the returns are generated.

You need to give us a 15 day prior Notice for the trade to be stopped as we may have existing position in Market, Pre mature exit may incur losses if market is not in favour of current position, still its based on individuals discretion , to cut off the existing position from the market.

Yes, We charge a small amount of Rs. 1000/ user to match the technology expenses .

We are not a PMS service provider nor we take any money from our clients, Each client has to open an account with Nirmal Bang securities pvt ltd , credit the funds in the new trading account and the strategy Bots will be deployed to Individual user based on the selection of strategies . Nirmal Bang uses XTS software from symphony for algo trades. Nirmal bang is our Broking partner for Algo Trades.

Min 5 lacs to max 10 crore per user.

You can see live trades from our dashboard login, which we provide after signing the contract with Golldencarat Pvt ltd .

- Option strategies -Limited Risk & reward ( credit spreads, debit spreads, calender spreads)

- Hedge fund strategy -limited Risk & unlimited reward ( buy futures and hedge with options)

- Strategy varies from Intraday to positional trades, as each user can select different strategies talking to our expert traders, which may suite individuals Risk profile.